Reverse home loans decrease the quantity of equity you have in your residence. As with any type of large financial decision, it is very important to weigh the benefits and drawbacks to see to it this is the right option for you Offering your house will unlock your equity and also supply you with cash flow that might surpass your assumptions if your house worth has appreciated. Yet if your home has actually valued in value, you might offer, downsize, and conserve or spend the added cash money. The finance as well as rate of interest are settled just when you market your home, completely relocate away, how can i get rid of my timeshare legally or die. Yet the loan provider does not establish to whom the residential or commercial property possession will certainly be provided.

- With a reverse financing, can the consumer take any amount, or does it have to be the complete portion?

- If you pass away, and your beneficiaries want to maintain the residence, they can re-finance to a standard home mortgage, purchase it for the quantity owed on the reverse mortgage or 95% of the assessed worth-- whichever is reduced.

- " In each situation where normal income or readily available savings are insufficient to cover costs, a reverse home mortgage can maintain seniors from counting on high-interest lines of credit or other a lot more pricey car loans," McClary says.

- This is due to the fact that when they acquire your home, they either need to repay the mortgage themselves or market the residential or commercial property to settle the loan.

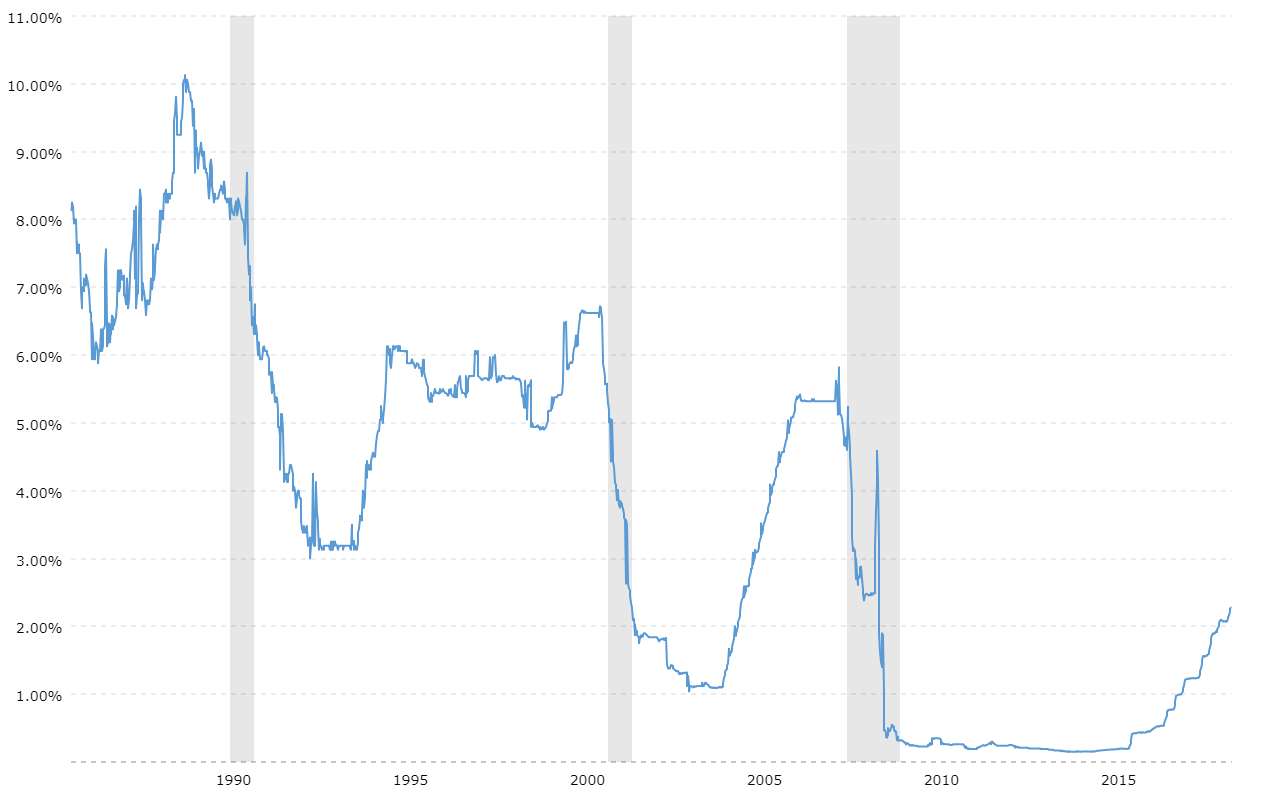

Adjustable-rate reverse mortgages generally have rates of interest that can alter on a monthly or annual basis within particular limitations. Additionally, there might be costs throughout the life of the reverse home mortgage. A month-to-month service fee might be put on the balance of the car loan (for example, $12 monthly), which after that compounds with the principal. Exclusive reverse home mortgages are personal fundings that are backed by the companies that create them. If you have a higher-valued residence, you might obtain a larger financing development from a proprietary reverse home mortgage. So if your residence has a higher appraised worth as well as you have a tiny mortgage, you could get more funds.

Versatile Repayment Options

Conversation with a lending institution about whether a reverse home mortgage is appropriate for you. Your rate of interest will certainly have an effect on just how much you get approved for. Due to the fact that passion fees are contributed to your car loan monthly, the lower the interest rate, the much more you'll be able to borrow. Reverse home mortgages can be an excellent suggestion for elders that need even more retired life revenue yet still want to live in their homes. Nonetheless, this may not be the very best option for you if you wish to pass your home down to your kids, or if you plan on leaving the residence soon. If you have a HECM, which is backed by the federal government, your loan is taken into consideration a non-recourse finance, suggesting you'll never owe more than your house deserves.

How Much Will I Owe When My timeshare presentation Reverse Home Loan Comes To Be Due?

Ideally, anybody interested in obtaining a reverse home loan will certainly put in the time to thoroughly learn more about just how these loans function. This way, no unethical lending institution or predacious scammer can prey on them, they'll have the ability to make an audio choice also if they get a poor-quality reverse mortgage counselor, and the lending won't feature any undesirable shocks. Just one partner may be a debtor if only one spouse holds title to the house, perhaps since it was inherited or because its possession precedes the marital relationship.

These finances last till the customer passes away or relocates, at which time they can settle the finance, or the building can be offered to settle the loan provider. The borrower gets any kind of cash that continues to be after the loan is paid off. A lot of reverse home mortgages have variable prices, which are linked to a monetary index and also change with the marketplace. Variable rate lendings often tend to offer you extra choices on how you get your cash with the reverse home mortgage.

The number of reverse home loans issued in the USA in 2020, up 23% from the previous year. Also called a Federal Housing Administration reverse mortgage, this kind of home loan is just readily available via an FHA-approved loan provider. It's likewise feasible to utilize a reverse home loan called a "HECM for purchase" to acquire a different house than the one in which you presently live. While they might feel like income to the home owner, the Irs takes into consideration the money to be a finance advance. A reverse mortgage is a sort of car loan for senior citizens ages 62 and also older. You should have the ability to maintain paying tax obligations, insurance coverage, and also various other prices.

Due to the fact that HECMs are government backed, some dishonest lenders have tried to target cash-strapped seniors with the guarantee that a reverse home mortgage is a safe means to access money for retirement. In most cases, the targeted people are not informed that real estate tax, insurance coverage and also home fixings have to continue to be spent for, creating them to back-pedal the finance as well as results in a simple cash advance for the underhanded loan provider. When the borrower of a reverse home mortgage passes away, the bank will review finance repayment options with the successors and inform them of the existing home loan balance. The heirs will usually have one month to choose what to do with the loan and also with the building. Proprietary reverse mortgages aren't insured by the federal government, therefore debtors aren't required to pay a monthly insurance policy costs or to take financial counseling. A reverse home mortgage is a sort of funding that allows house owners ages 62 as well as older, normally who have actually settled their mortgage, to borrow component of their residence's equity as tax-free income.

As kept in mind earlier, the lending institution might call the financing due in any of the above-described situations. Reverse mortgage lending institutions are generally fast to begin a foreclosure after a default occurs. You can pick to shield a percent of the ultimate net sale earnings of your residence. When your loan is paid off, you're guaranteed to have this selected percentage returned to you (approximately 50%). Read about the benefits and drawbacks of a reverse home loan to see if it is right for you.

The non-borrowing partner can also lose the home if the loaning spouse needed to move into a nursing home or nursing home for a year or longer. Reverse mortgage permit property owners to convert their home equity right into cash money earnings without any regular monthly timeshare clearing house mortgage repayments. Ultimately, also if you do not need to make home mortgage payments, you're still in charge of the relevant property taxes, property owner insurance coverage, and also maintenance. While you won't need to make monthly financing payments, you will likely have to make regular monthly payments to cover real estate tax and also insurance policy as well as look after recurring upkeep expenses.